In recent years split payment options, or buy now pay later as it’s more well known, have become more and more popular when shopping online. Buy now pay later options carry many benefits for both shoppers and online business owners.

Their increasing popularity has sprung up new payment gateway businesses such as LayBuy who offer a split in 6 option, which keeps it simple with interest-free financing for your customers. With more and more demand for flexible payments, we believe that split payments are the future of online shopping and we’re going to be talking about the benefits of buy now pay later options for your online shop.

Flexibility and choice

Firstly, many shoppers want flexibility in how they pay for their online shopping items. With many shopping for higher-priced items or a larger basket value, having the option to split the total cost gives the shopper the control and convenience of paying over a few months rather than all at once.

Providing your customers with a choice on your shop’s checkout will help encourage them to check out with their items better than having only one payment choice. It also helps to indicate trust on your checkout page. Having larger and more well-known brands featured, like PayPal, as well as other payment options demonstrates that you work with reliable and trusted payment gateways.

Increased conversion

Giving your customers more options on your shop’s checkout will only help to increase your conversion rate as you’re giving them the choice and putting the power in their hands. If they feel in control because of the payment options available to them, whether they choose the buy now pay later option or not, by simply having more than 1 payment option, they’re more likely to check out.

Higher basket value

A buy now pay later option can also help encourage your customers to add related products to their shopping basket too. Adding more products and increasing the basket value is only a benefit for your business. And the customer, while spending more money, is happier to do so because they are able to split the payments up.

There are other things you can do on your checkout page to encourage conversion, such as offering free delivery or a free product if the value is over a certain amount. When people can see they could get something for free they’re more likely to click on that checkout button as they perceive the value of their basket is now higher due to the free item or delivery.

Why buy now pay later?

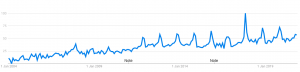

As a business owner, there are many benefits to having buy now pay later options on your shop’s checkout. Not only that but it’s search popularity online has boomed since 2004.

With flexible payment options becoming more and more popular amongst shoppers, we expect this trend to continue to grow. Helped by it’s ever-growing popularity, buy now pay later options have a good reputation as a finance option compared to others such as payday loans.

The younger generation is also more likely to checkout online using a buy now pay later option rather than traditional pay by debit or credit card. A recent article by Marketing Week has suggested that there is now a disconnect between credit card brands and the younger generation. As we become more of a cashless society, buy now pay later options give consumers the instant gratification of purchasing something they desire and speaks to the distrust we have in credit cards.

The post Is Buy Now Pay Later the future of online payments? appeared first on Ecommerce Blog.

from Ecommerce Blog https://ift.tt/2Um3qjq

from Ecommerce Blog https://ift.tt/2Um3qjq via IFTTT

via IFTTT

No comments:

Post a Comment