In recent years we’ve seen a whole bunch of visual/style fashion-focused search engines cropping up, tailored to helping people find the perfect threads to buy online by applying computer vision and other AI technologies to perform smarter-than-keywords visual search which can easily match and surface specific shapes and styles. Startups like Donde Search, Glisten and Stye.ai to name a few.

Early stage London-based Cadeera, which is in the midst of raising a seed round, wants to apply a similar AI visual search approach but for interior decor. All through the pandemic it’s been working on a prototype with the aim of making ecommerce discovery of taste-driven items like sofas, armchairs and coffee tables a whole lot more inspirational.

Founder and CEO Sebastian Spiegler, an early (former) SwiftKey employee with a PhD in machine learning and natural language processing, walked TechCrunch through a demo of the current prototype.

The software offers a multi-step UX geared towards first identifying a person’s decor style preferences — which it does by getting them to give a verdict on a number of look book images of rooms staged in different interior decor styles (via a Tinder-style swipe left or right).

It then uses these taste signals to start suggesting specific items to buy (e.g. armchairs, sofas etc) that fit the styles they’ve liked. The user can continue to influence selections by asking to see other similar items (‘more like this’), or see less similar items to broaden the range of stuff they’re shown — injecting a little serendipity into their search.

The platform also lets users search by uploading an image — with Cadeera then parsing its database to surface similar looking items which are available for sale.

It has an AR component on its product map, too — which will eventually also let users visualize a potential purchase in situ in their home. Voice search will also be supported.

“Keyword search is fundamentally broken,” argues Spiegler. “Image you’re refurbishing or renovating your home and you say I’m looking for something, I’ve seen it somewhere, I only know when I see it, and I don’t really know what I want yet — so the [challenge we’re addressing is this] whole process of figuring out what you want.”

“The mission is understanding personal preferences. If you don’t know yourself what you’re looking for we’re basically helping you with visual clues and with personalization and with inspiration pieces — which can be content, images and then at some point community as well — to figure out what you want. And for the retailer it helps them to understand what their clients want.”

“It increases trust, you’re more sure about your purchases, you’re less likely to return something — which is a huge cost to retailers. And, at the same time, you may also buy more because you more easily find things you can buy,” he adds.

Ecommerce has had a massive boost from the pandemic which continues to drive shopping online. But the flip side of that is bricks-and-mortar retailers have been hit hard.

The situation may be especially difficult for furniture retailers that may well have been operating showrooms before COVID-19 — relying upon customers being able to browse in-person to drive discovery and sales — so they are likely to be looking for smart tools that can help them transition to and/or increase online sales.

And sector-specific visual search engines do seem likely to see uplift as part of the wider pandemic-driven ecommerce shift.

“The reason why I want to start with interior design/home decor and furniture is that it’s a clearly underserved market. There’s no-one out there, in my view, that has cracked the way to search and find things more easily,” Spiegler tells TechCrunch. “In fashion there are quite a few companies out there. And I feel like we can master furniture and home decor and then move into other sectors. But for me the opportunity is here.”

“We can take a lot of the ideas from the fashion sector and apply it to furniture,” he adds. “I feel like there’s a huge gap — and no-one has looked at it sufficiently.”

The size of the opportunity Cadeera is targeting is a $10BN-$20BN market globally, per Spiegler.

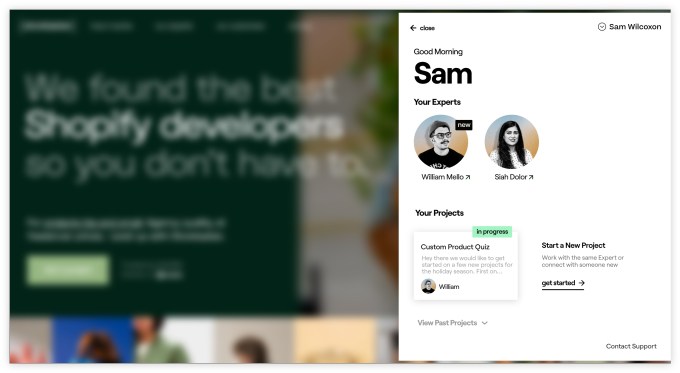

The startup’s initial business model is b2b — with the plan being to start selling its SaaS to ecommerce retailers to integrate the visual search tools directly into their own websites.

Spiegler says they’re working with a “big” UK-based vintage platform — and aiming to get something launched to the market within the next six to nine months with one to two customers.

They will also — as a next order of business — offer apps for ecommerce platforms such as WooCommerce, BigCommerce and Shopify to integrate a set of their search tools. (Larger retailers will get more customization of the platform, though.)

On the question of whether Cadeera might develop a b2c offer by launching a direct consumer app itself, Spiegler admits that is an “end goal”.

“This is the million dollar question — my end-goal, my target is building a consumer app. Building a central place where all your shopping preferences are stored — kind of a mix of Instagram where you see inspiration and Pinterest where you can keep what you looked at and then get relevant recommendations,” he says.

“This is basically the idea of a product search engine we want to build. But what I’m showing you are the steps to get there… and we hopefully end in the place where we have a community, we have a b2c app. But the way I look at it is we start through b2b and then at some point switch the direction and open it up by providing a single entry point for the consumer.”

But, for now, the b2b route means Cadeera can work closely with retailers in the meanwhile — increasing its understanding of retail market dynamics and getting access to key data needed power its platform, such as style look books and item databases.

“What we end up with is a large inventory data-set/database, a design knowledge base and imagery and style meta information. And on top of that we do object detection, object recognition, recommendation, so the whole shebang in AI — for the purpose of personalization, exploration, search and suggestion/recommendation,” he goes on, sketching the various tech components involved.

“On the other side we provide an API so you can integrate into use as well. And if you need we can also provide with a responsive UX/UI.”

“Beyond all of that we are creating an interesting data asset where we understand what the user wants — so we have user profiles, and in the future those user profiles can be cross-platform. So if you purchase something at one ecommerce site or one retailer you can then go to another retailer and we can make relevant recommendations based on what you purchased somewhere else,” he adds. “So your whole purchasing history, your style preferences and interaction data will allow you to get the most relevant recommendations.”

While the usual tech giant suspects still dominate general markets for search (Google) and ecommerce (Amazon), Cadeera isn’t concerned about competition from the biggest global platforms — given they are not focused on tailoring tools for a specific furniture/home decor niche.

He also points out that Amazon continues to do a very poor job on recommendations on its own site, despite having heaps of data.

“I’ve been asking — and I’ve been asked as well — so many times why is Amazon doing such a poor job on recommendations and in search. The true answer is I don’t know! They have probably the best data set… but the recommendations are poor,” he says. “What we’re doing here is trying to reinvent a whole product. Search should work… and the inspiration part, for things that are more opaque, is something important that is missing with anything I’ve seen so far.”

And while Facebook did acquire a home decor-focused visual search service (called GrokStyle) back in 2019, Spiegler suggests it’s most likely to integrate their tech (which included AR for visualization) into its own marketplace — whereas he’s convinced most retailers will want to be able to remain independent of the Facebook walled garden.

“GrokStyle will become part of Facebook marketplace but if you’re a retailer the big question is how much do you want to integrate into Facebook, how much do you want to be dependent on Facebook? And I think that’s a big question for a lot of retailers. Do you want to dependent on Google? Do you want to be dependent on Amazon? Do you want to be dependent on Facebook?” he says. “My guess is no. Because you basically want to stay as far away as possible because they’re going to eat up your lunch.”

from eCommerce – TechCrunch https://ift.tt/2NC3bjR

from eCommerce – TechCrunch https://ift.tt/2NC3bjR via IFTTT

via IFTTT

Today, Luke Toudup of ZigZag Global discusses what retailers should expect from Retail Returns in 2021 and how retailers can, and in some cases already are, adapting to serve customers in the new retail landscape created by COVID.

Today, Luke Toudup of ZigZag Global discusses what retailers should expect from Retail Returns in 2021 and how retailers can, and in some cases already are, adapting to serve customers in the new retail landscape created by COVID.