Scotland is slowly but surely drawing attention in the UK’s startup space. In 2020, Scottish startups collectively raised £345 million, according to Tech Nation, and with nearly 2,500 startups, it has the highest number of budding tech companies outside London. Venture capital fundraises are also consistently on the rise every year.

Scotland’s capital Edinburgh boasts a beautiful, hilly landscape, a robust education system and good access to grant funding, public and private investment. It’s also one of the top financial centers in the U.K., making it a great place to begin a business.

So to find out what the startup scene in Edinburgh looks like, we spoke to six founders, executives and investors. The city’s tech ecosystem appears to have a robust space for machine learning, artificial intelligence, biomedicine, fintech, travel tech, oil, renewables, e-commerce, gaming, health tech, deep tech, space tech and insurtech.

Use discount code SCOTLANDSURVEY to save 25% off an annual or two-year Extra Crunch membership.

This offer is only available to readers in the UK Europe and expires on June 30, 2021.

However, the city’s tech scene is apparently lackluster when it comes to legal tech, blockchain and consumer-facing technology.

Breakout companies that were founded in Edinburgh include Skyscanner and FanDuel. Notable among the current crop are Desana, Continuum Industries, Parsley Box, Current Health, Boundary, Zumo, Appointedd, Criton, Mallzee, TravelNest, TVSquared, Care Sourcer, Stampede, For-Sight, Vistalworks, Reath, InfraCost, Speech Graphics and Cyan Forensics.

The Edinburgh business-angel community appears to be quite strong, but it seems local founders find it difficult to get London-based investors to take an interest. Scottish investors are said to be “pretty conservative and risk-adverse” with some notable exceptions.

We surveyed:

- Wendy Lamin, managing director, Holoxica

- Andrew Noble, partner, Par Equity

- Danae Shell, co-founder and CEO, Valla

- Allan Nelson, co-founder and CEO, For-Sight

- Lysimachos Zografos, founder, Parkure

- Bertie Wilson, co-founder in stealth mode

Wendy Lamin, managing director, Holoxica

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

It’s strong in space, biomedicine, fintech/insurtech, AI.

What are the tech investors like in Edinburgh? What’s their focus?

The Scottish business-angel community is said to be the largest in Europe. It’s difficult to get London-based investors take an interest in Scotland — investors can tend to look at where companies are based. It is hard for “underrepresented founders” to get investments in Scotland and beyond.

With the shift to remote working, do you think people will stay in Edinburgh or will they move out? Will others move in?

Stay. Not always easy to get people to come and live in Scotland. Edinburgh, there are lots of prejudices, despite it being one of the best cities to live in in the whole of the U.K.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Good to see more focus on impact investing. Par Equity is one of Edinburgh’s biggest investors, whereas Archangels is one of the biggest angel investors. Poonam Malik is great for diversity and female entrepreneurs, and she is on the board of Scottish Enterprise, and is a social entrepreneur and investor. Garry Bernstein is also an investor — he leads the Scottish chapter of Tech London Advocates and Global Tech Advocates, and as such is the founder of Tech Scot Advocates.

Where do you think the city’s tech scene will be in five years?

Thriving. The government is doing its best for the tech sector. Education in tech is currently an issue, though. Hope Brexit won’t be too much of an issue.

Andrew Noble, partner, Par Equity

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Strong in fintech, health tech, data science, deep tech. Excited by quantum computing, advanced materials, AI in Edinburgh. Weak in blockchain and consumer.

Which are the most interesting startups in Edinburgh?

Current Health, InfraCost, Speech Graphics and Cyan Forensics.

What are the tech investors like in Edinburgh? What’s their focus?

Good at seed stage up to £1 million, okay for pre-series A (£1 million to £3 million) and non-existent for Series A (£3 million-£10 million). Quality of investors is improving. Par Equity is leading the way.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

Experiencing influx of new talent due to COVID-19. Edinburgh is a highly desirable city to live in. Recent new residents include Aaron Ross (Predictable Revenue) and Jules Pursuad (early employee at Airbnb and now VP at Omio).

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Par Equity (investor), Paul Atkinson, Alistair Forbes, Mark Logan, Lesley Eccles, Chris McCann, CodeBase.

Where do you think the city’s tech scene will be in five years?

One to two new unicorns. Promising number of high-growth tech companies. A much more sophisticated investor scene in the Series A space.

Danae Shell, co-founder and CEO, Valla

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Edinburgh is strong in fintech because of our proximity to so many financial services companies and banks. Also, there are some exciting games tech companies because of our history of games companies. We’re pretty weak in law tech, Valla’s area.

Which are the most interesting startups in Edinburgh?

Vistalworks for consumer tech; Sustainably for fintech; Reath for sustainable tech.

What are the tech investors like in Edinburgh? What’s their focus?

As a rule, Scottish investors are pretty conservative and risk-averse. The only real exception is Techstart Ventures, in my experience.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

I think more people will come to Edinburgh from London because the quality of life and cost of living are both so much better here.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Calum Forsyth and Mark Hogarth at Techstart Ventures; Janine Matheson at CodeBase; Jackie Waring from the Investing Women angel syndicate; Jim Newbury is a very well-respected developer and coach, and my co-founder Kate Ho is also well known. Also Danny Helson who runs the EIE event with the Bayes Centre.

Where do you think the city’s tech scene will be in five years?

We’ve had a few exits in the past few years (Skyscanner, FreeAgent), which means that talent is spreading out across the ecosystem here and we’re getting some fantastic new startups kicking off. In five years, that first crop should be coming into the Series A stage so we could see a lot of super exciting businesses!

Allan Nelson, co-founder and CEO, For-Sight

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Strong in fintech, travel tech, health, oil, renewables, e-commerce, gaming (both video game and gambling tech). Excited by all bar oil (great driver of revenue, but not the future).

Which are the most interesting startups in Edinburgh?

Boundary, Parsley Box, Appointedd, Criton, Mallzee, TravelNest, TVSquared, Care Sourcer, Stampede, For-Sight.

What are the tech investors like in Edinburgh? What’s their focus?

Big fintech scene here. Travel tech is growing too, with Skyscanner’s influence strong.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

Most will stay, as it’s a very attractive city to live and work in. It’s a globally recognized and unique city. Very international flavor as evidenced by the makeup of our team.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Ex-Skyscanner people including Gareth Williams, Mark Logan, etc. Ian Ritchie, Alistair Forbes, the FanDuel’s founders and the CodeBase founders.

Where do you think the city’s tech scene will be in five years?

A lot bigger, as tech is a key growth target of the Scottish government and is underpinned/influenced/inspired by Skyscanner and FanDuel.

Lysimachos Zografos, founder, Parkure

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Strong in machine learning/AI/digital. Weak in deep tech discovery, especially in biotech/therapeutics. Excited by the rise in adoption of AI in drug discovery — all these ideas that were sci-fi 20 years ago are now adopted in £B deals.

Which are the most interesting startups in Edinburgh?

Pheno Therapeutics.

What are the tech investors like in Edinburgh? What’s their focus?

Conservative angels and a few tech seed VCs.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

Move in.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Investors: Archangels, Techstart Ventures and Epidarex.

Where do you think the city’s tech scene will be in five years?

Growing.

Bertie Wilson, co-founder, “Stealth mode”

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

I don’t think there are any sectors that stand out — it’s fairly evenly split. A good strength of the city is the talent that comes from the universities. There are some really good engineers that come from Edinburgh, Heriot Watt and Edinburgh Napier. The main weakness is that the ecosystem doesn’t favor the most ambitious founders. Most investors in the region are angels and aren’t interested in finding outliers that could grow 1000x and are more interested in backing companies that are less risky but might 5x their money. If you want to find investors that will back risky (but very ambitious) plans, it’s easier to find that elsewhere.

Which are the most interesting startups in Edinburgh?

Desana, Continuum Industries, Parsley Box, Current Health, Boundary, Zumo.

What are the tech investors like in Edinburgh? What’s their focus?

I would say it’s getting better, but there are still a lot of issues with the ecosystem. It is being helped in Scotland by the likes of Techstart investing at the earliest stages with high conviction and term sheets that are more similar to London VCs. Outside of this, though, it’s easy for founders to end up with a messy cap table due to the number of angels and lack of VCs looking for VC-type returns — the messiness of these cap tables can then make it hard to raise venture funding down the line. This is fine for a lot of companies that aren’t aiming for a venture-scale return (which admittedly is a lot), but it can hurt those that are.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

I imagine and hope others will move in. It is a great place to live with a very high quality of life, and this should be a natural attraction for people who want a good standard of living but want to remain in a city.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

SEP (investor), Techstart Ventures (investor), Gareth Williams (founder/investor), MBM Commercial (lawyers), Pentech, Bill Dobbie (investor), Jamie Coleman.

Where do you think the city’s tech scene will be in five years?

Optimistically, I hope that there will be a good number of companies that are at the Series B/Series C stage, which will invite a lot more interest from investors outside of Edinburgh (London, Berlin, Paris, New York, San Francisco, etc.) to start investing more actively in the city at the earliest stages as well as these stages.

from eCommerce – TechCrunch https://ift.tt/3vx2hGp

via

IFTTT

from Ecommerce – Tamebay https://ift.tt/2TwPFkE

from Ecommerce – Tamebay https://ift.tt/2TwPFkE via IFTTT

via IFTTT

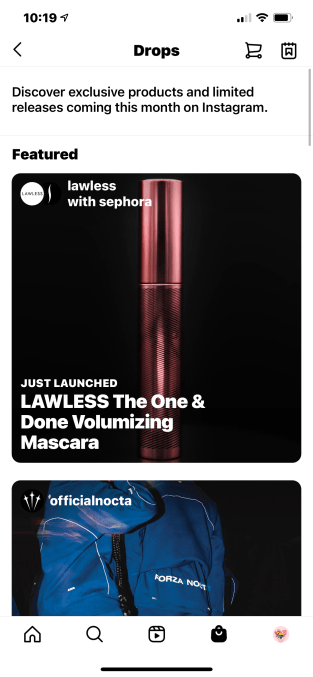

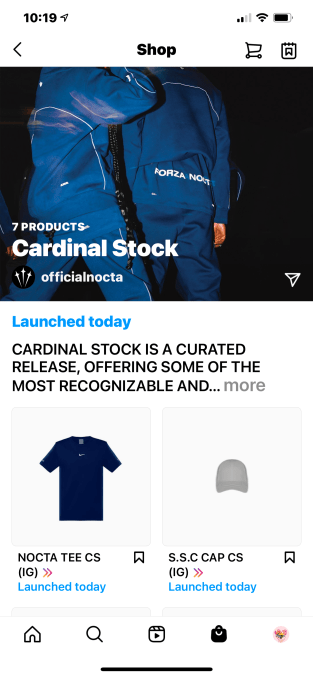

“The impact of the pandemic on social commerce is significant. Over the past year, commerce has become a cornerstone feature for social platforms, as consumers have spent more time on social apps.

“The impact of the pandemic on social commerce is significant. Over the past year, commerce has become a cornerstone feature for social platforms, as consumers have spent more time on social apps.