What's PayPal Recurring Payments?

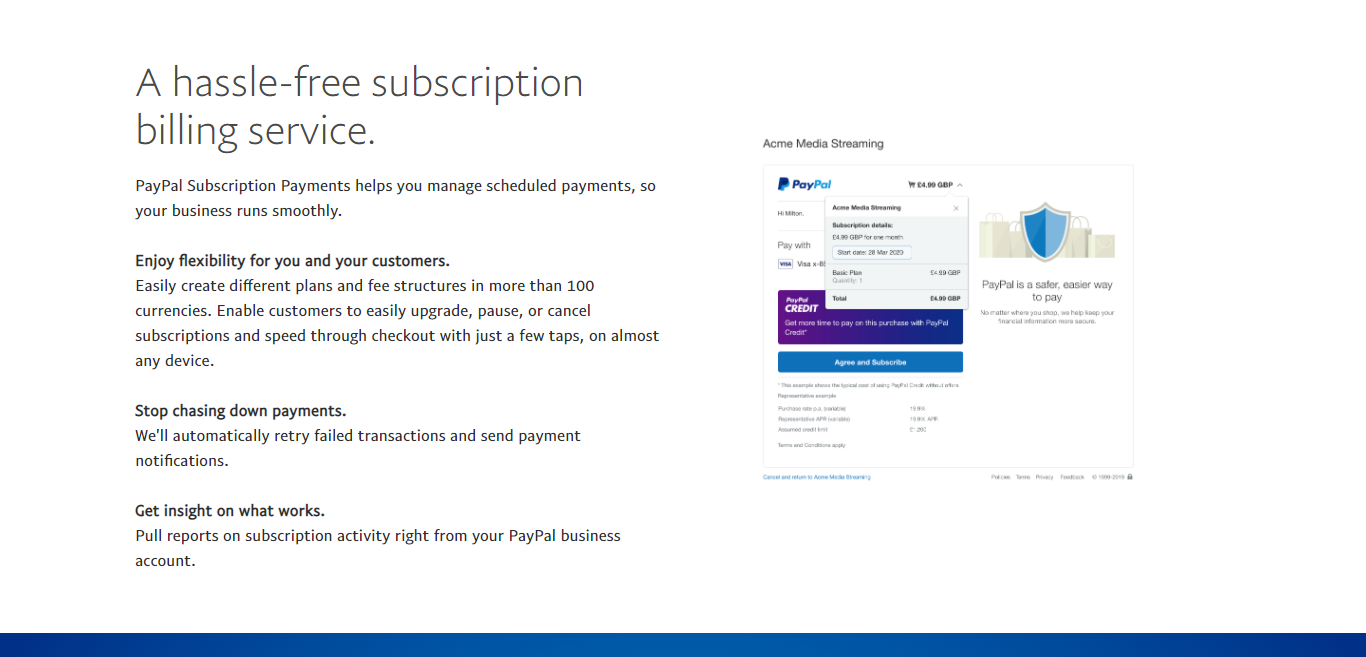

PayPal Recurring Payments is an easy way for you to accept online credit and debit cards, PayPal, and e-wallet payments and manage automatic repeat billing. Most notably, via online invoicing, email, and website sales.

This makes PayPal Recurring Payments ideal for any entrepreneur with an online business that wants to bill customers for memberships, subscriptions, or repeat products and/or services. It's also worth bearing in mind that this service offers your customers a degree of flexibility, as you can offer partial payment plans.

If you're a busy business owner who's always on the run, you may also be happy to hear that PayPal has an app you can use. As such, you can manage your subscription billing whenever, wherever.

Please note that PayPal Recurring Payments doesn't accept e-checks or ACH payments at the time of writing.

How Much Will PayPal Recurring Payments Set You Back?

There aren't any monthly fees. Instead, you pay a recurring payment processing fee of 2.9% plus 30 cents per transaction.

For more info check out our full PayPal review.

The Pros and Cons of Using PayPal Recurring Payments

Let's start with the perks…

PayPal's Brand Name Carry's Some Weight

PayPal is a widely used brand worldwide, which works wonders for instilling confidence in your shoppers. In fact, in terms of PayPal’s brand recognition, it's 72% compared to other popular payment gateways whose recognition is below 50%.

Go Global

PayPal boasts 137 million active accounts from users across 193 countries. If you're looking to reach an international audience, this could well be an excellent choice for you. In fact, PayPal Recurring Payments empowers you to accept payments across 24 international currencies.

Monitor Your Transactions

With just a click, you can keep an eye on both your inbound and outbound transactions. You can also download your entire transaction history and pass this to your accountant when tax season comes around.

The Drawbacks

Now for the disadvantages of using PayPal Recurring Payments:

There Are Strict Rules You Need to Follow

Since as long ago as September 2011, PayPal's rules have become increasingly strict to protect against fraud. Consequently, any slight change in your average transaction value can result in your account being frozen and your money locked in, so you're unable to access it. Lots of PayPal users complain that PayPal rarely provides an explanation as to why the account has been frozen, or worse yet, closed – and merchants can't appeal the decision, so they just have to lump it!

Lousy Customer Service

Having read the point above, it probably isn't a surprise that PayPal's customer service doesn't fare too well. Some users complain about having to jump through hoops to speak to a real-life customer support rep, rather than a bot, an FAQ page, or a generic email.

PayPal's Verification Process is Long

Although setting up a PayPal business account is relatively easy, having your account “verified” can struggle a hassle. Now and then, PayPal requires extra documentation to verify your account. Most notably, utility bills and government-issues.

How to Set Up PayPal Recurring Payments

- Log into your PayPal Business account.

- Head to the ‘Manage Subscriptions' page, and then click ‘Create Plan.'

- Provide a few details about the products or services included in the plan, most notably, its name, a brief description of what's included, and your product ID.

- You'll then need to select the product type (physical goods, digital goods, or service), and pick the industry category that best describes your business.

- In a separate tab, head to your subscription plan's sales page, copy, and paste this into the fields that say ‘Product Page URL.'

- Now, click ‘Next.'

- Next, pick whether you want to opt for fixed pricing or quantity pricing, then when you're ready, click ‘Next.' Please note that: Based on your customer's chosen subscription plan, ‘fixed pricing' charges the customer's the same each billing cycle. Whereas, ‘quantity pricing' charges the customer's the same each billing cycle depending on their chosen quantity.

- It's now time to create a plan name (this is visible to your customers) and description (this is your own reference; your customers can't see this). When you're done, click ‘Next.'

- Next, you need to set the price of your subscription plan. This involves selecting your desired currency, price, disclosing whether you charge a one-time set-up fee (optional), and selling how you'll calculate tax for the plan. You'll then need to enter your tax rate and select ‘Next' when you're finished.

- This next step involves selecting your billing cycle for your subscription plan – i.e., how frequently you'll charge your subscribers – daily, weekly, monthly, yearly, etc. You'll also have to specify the plan's length and the number of payments necessary for PayPal to stop attempting to take charge. At this point, you can even say whether you offer a trial period (optional). Then, when you're finished, click ‘Next.'

- Last but not least, you're ready to confirm your subscription plan's details and then hit ‘Save Plan' when you're happy and ensure you’re ready to ‘Turn on Plan.'

- At this point, you can now add a subscription payment button to your website.

Are You Ready to Start Using PayPal Recurring Payments?

If, having read this review, you think PayPal Recurring Payments could be the right solution for your subscription-based business, then let us know how you get on in the comments box below. We'd love to hear from you!

The post What’s PayPal Recurring Payments? appeared first on Ecommerce Platforms.

from Ecommerce Platforms https://ift.tt/37VHHGX

from Ecommerce Platforms https://ift.tt/37VHHGX via IFTTT

via IFTTT

No comments:

Post a Comment