There are plenty of options out there these days. After all, the growth of the internet and the availability of mobile payments means that virtually anyone can set up their own store and start making sales, whenever and wherever they like. All they need is the right payment processing solution, and they're ready to go.

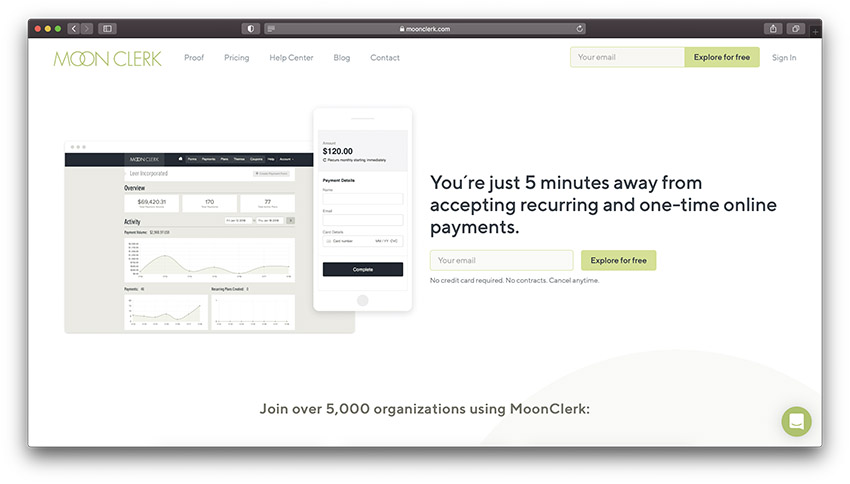

MoonClerk is just one of the many payment processing services designed for small and mid-sized companies on the market today. It's a cloud-based offering (which means that everything operates over the internet). What's more, this tool comes with access to everything from mobile payment management features, invoicing, recurring billing, and online transaction support.

Whether you need something to handle single payments, subscriptions, donations, or something else entirely, MoonClerk allows users to design their own customizable payment strategies and embed them into their business websites. You can also share payment links via live chat, SMS, emails, and other methods to request payments for customers.

What is MoonClerk?

So, what exactly is MoonClerk?

As we mentioned above, MoonClerk is a payment processing solution that reduces some of the hassle associated with running a digital business. There are MoonClerk strategies to suit every style of pricing model, from one-off payments, to subscriptions.

The online application offers easy access to tools and strategies for growing an effective digital store. MoonClerk even has it’s own knowledgebase at http://help.mooncler.com to get you started. Whether you’re completing one-time or recurring transactions, MoonClerk will help you to manage your day-to-day payments securely and conveniently.

MoonClerk benefits from a positive reputation thanks to its versatility and consistent reliability. The system offers a selection of seamless and hassle-free solutions for payment processing. What’s more, it doesn’t matter whether users are in the field, in-office, or anywhere else. MoonClerk gets you paid wherever your business might go.

MoonClerk operates on top of the Stripe payment processor – one of the most popular payment processers in the world. Because Stripe is one of the largest and most secure ways to manage transactions, Moon Clerk can offer today’s businesses excellent peace of mind. What’s more, MoonClerk is available anywhere Stripe services are available.

MoonClerk Pros and Cons

Just like any SaaS solution, MoonClerk comes with a variety of positive and negative factors to consider. This powerful payment processing solution comes with a variety of payment methods, and access to various tools, like reports to improve the insights you get from Google analytics.

MoonClerk is easy to use, and highly customizable, so you can ensure that it’s perfectly suited to your business. However, that doesn’t mean that MoonClerk will be the right payment processor for every company. Here are some pros and cons to consider.

Pros 👍

- Easy to use: You don’t need any technical expertise to excel with MoonClerk, or any insight into how to program code. Businesses of any size can tap into the functionality of the system. MoonClerk can even host your online presence for you.

- No merchant account required: You can start using the software immediately. You can even receive your payments into your accounts within a matter of minutes.

- Customization: MoonClerk makes it easy to customize the shopping experience to reflect your brand. For instance, you can add different logos, colors, and fonts to your interface.

- Complete control: Business owners have excellent control over their organizations. You can set parameters for digital downloads, and trial periods, and track various other parts of your transactions.

- Security: MoonClerk protects your payments and online transactions through state-of-the-art security solutions. These solutions or on the same level as bank-level security, so you know you’re safe.

- Compatible with various tools: MoonClerk can integrate with and work alongside a variety of different tools. This makes it excellent for combining various aspects of your website.

Cons 👎

- Specifically connected to Stripe: Stripe is one of the most popular payment system solutions in the world. However, if you’re not a fan of Stripe, then you can’t switch to a different payment option with MoonClerk.

- Available in some countries: MoonClerk is available in all of the countries where you can access Stripe. However, this will mean that some countries will still miss out on MoonClerk functionality.

- Customers can’t choose their own preferences: If you’re running a non-profit where customers can choose the amount that they want to donate each month, your clients will have to come to you to arrange the update.

MoonClerk Review: Features

MoonClerk was created by two men, Ryan Wood, and Dodd Caldwell.

The pair said that they wanted to create the service because they were looking for something similar that they could use themselves. Before MoonClerk arrived in the marketplace, it was challenging to set up recurring payment schedules.

According to Caldwell, before he began working on MoonClerk, was building non-profit software for businesses through an organization that he had built himself, “Bellstrike.” When he was unable to find a software solution that made it easy for him to establish recurring payments, he set about making one himself.

Some of the most impressive features of the resulting MoonClerk software are:

- Customizable payment form creation

- Adaptable branding

- Coupon and voucher creation

- Data export

- Website-embeddable payment forms

- Customer information storage

- Payment history

- Recurring payment plans

- Custom payment options

- Payment activity statistics

MoonClerk Review: Pricing

No matter what kind of software you're investing in for your company, the price has to be right.

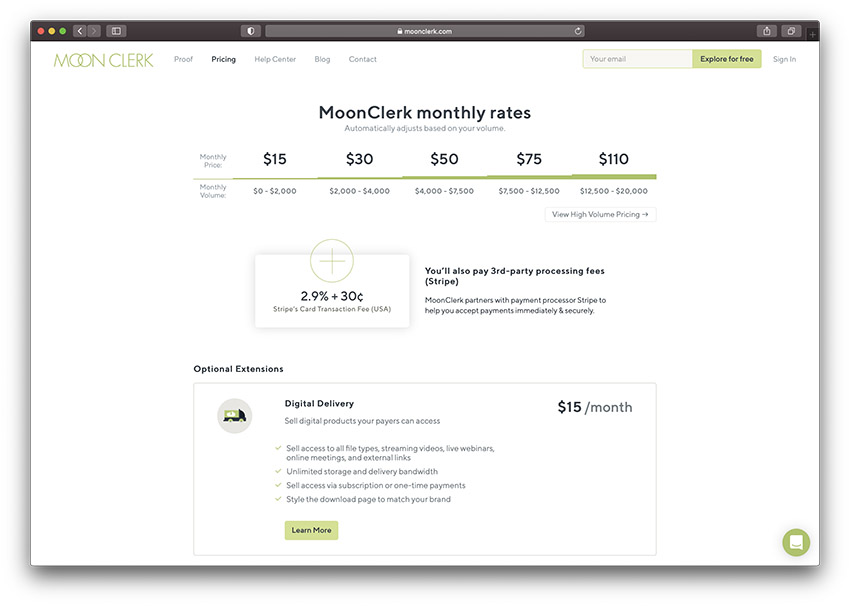

Fortunately, for most businesses, MoonClerk pricing is relatively simple to understand. There's just one subscription plan to choose from, and your monthly rates will adjust automatically according to the sales volume that you're dealing with.

Prices for MoonClerk range from $15 per month for transactions worth up to $2,000, to around $500 per month for up to $150,000 worth of transactions.

Essentially, the more you earn, the more you pay to process everything.

Additionally, MoonClerk also charges additional third-party processing fees of 2.9% plus 30 cents for your card transactions too. These are the same processing fees that you'll see in Stripe, the payment platform that MoonClerk is built on top of.

If you decide that you want to start selling digital products, then you're going to need to pay a little extra for something called “digital delivery” too. This is an optional extension feature for $15 per month, which comes with unlimited delivery bandwidth and storage. Additionally, it allows you to upload any content type you like, from videos to eBooks, and sell it to customers on a subscription basis, or via a one-off payment.

You can even adjust the style of the download page for your digital content so that it matches your branding elsewhere.

Notably, there are a few extra things you should be aware of regarding MoonClerk pricing.

- Transaction fees are lower for US-based bank account transactions through ACH. Stripe only charges a fee of 0.8% here, with a cap of $5 for payments made from ACH.

- There are no contracts or set-up fees involved when you start using MoonClerk. However, the MoonClerk pricing you pay will adjust automatically according to your transactions.

- There is a minimum monthly fee of $15 per month once you activate your account with MoonClerk, regardless of what your transaction volume might be.

MoonClerk Review: Usability

Now that we've covered the basics of MoonClerk pricing, it's worth examining how easy it is to use this technology. Operating MoonClerk doesn't demand any specific technical-level skills or a knowledge of programming code – so that's a good start.

The solution has been designed to appeal to businesses no matter how small, regardless of how much background you might have with using apps and payment processing software. You don't even need your own website to get started, because MoonClerk will host everything for you.

Additionally, users can get started straight away by using their software as soon as they make a purchase. You don't need a merchant account to be set up, and you can begin creating payment forms to add to your site whenever you like.

The benefits of MoonClerk usability include:

- No need for any coding knowledge

- Set up in minutes for any business

- No merchant account necessary

- All hosting and security provided by MoonClerk

- Access your software on any mobile or desktop device

MoonClerk Review: Taking Payments

MoonClerk is a simple solution for using Stripe to take payments from customers in a range of different business structures. Non-developers and smaller companies can easily set up their web presence using MoonClerk, and there's the option to customize the payment processing experience in a range of ways. For instance, merchants can:

- Allow payers to choose their own recurring payment options

- Set custom charge days, frequencies, and trial periods

- Create installment plans for payers

- Charge recurring surcharges and upfront fees

- Create flexible vouchers and coupons

- Use MoonClerk as a virtual terminal

- Send payment links via invoices, social media, email, SMS and more

Additionally, MoonClerk benefits from being able to accept payments in various forms, which makes the MoonClerk pricing more competitive. You can take payments via ACH (e-Check), debit cards, credit cards, Google Pay, Apple Pay, and Microsoft Pay too.

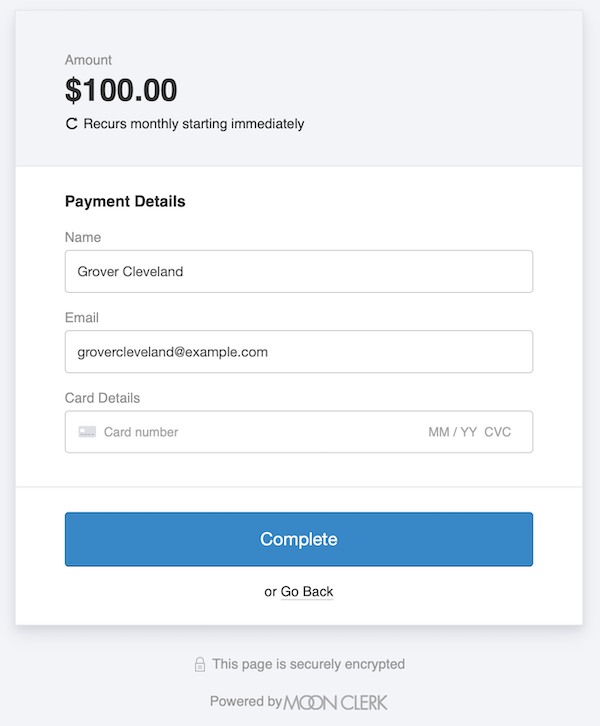

MoonClerk supports monthly, quarterly, and annual recurring payments, as well as one-time fees. When you're just getting started for the first time, the application will walk you through the process of designing a checkout experience that's perfectly suited to your brand and customers. You can also design your form using several options related to the checkout process. For instance, you can decide whether you need to add a standard percentage alongside the total or charge a specific shipping fee.

You also have the freedom to determine what day in the month a recurring payment should be deducted from a customer.

MoonClerk Review: Transfers

After you've created your form and deducted whatever necessary payments from your customer, you'll be able to provide your own banking information to Stripe Connect. This will allow you to accept payments from your customers through Stripe.

The fact that MoonClerk is built on top of Stripe is a positive thing for some customers, particularly those who have had their accounts frozen by other companies like PayPal and Square in the past. Stripe generally ensures that businesses and merchants get their money within 2 business days of a successful charge going through. Additionally, funds are automatically transferred into your bank account on a rolling 2-day basis. This means that if someone sends you cash on Tuesday, you should have it with your bank by Thursday on the same week.

Transfers can take a little bit longer if you're accepting ACH payments. Once a checkout is complete with an e-check, the first payment will take up to 5 business days to complete. It will also take up to 7 business days for your payments to be reflected in the available balance that you have on Stripe.

Overall, our MoonClerk review found that transfers and receiving money from MoonClerk are simple enough.

👉 Benefits include:

- Being able to send funds to your bank account automatically

- Integrating with hundreds of third-party providers

- Giving payers control over their accounts

- Retrying failed payments automatically

- Filter and exporting payment data

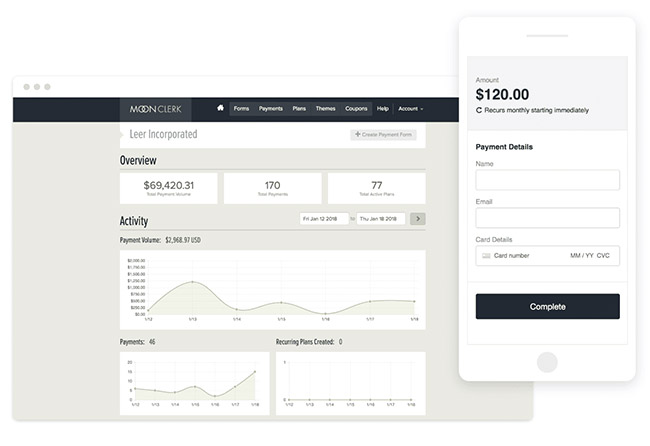

MoonClerk Review: Form Builder

Probably one of the most essential tools you'll use on MoonClerk is the payment form builder. This solution is designed to help companies and merchants request fees from clients in a range of different ways. You can even embed your own payment form on your website.

To build a standard payment form, all you need to do is click on the “Forms” link at the top of your navigation menu and create a new form for your product. You can add titles, descriptions, and sale prices, as well as itemized prices for various products, and suggested prices for donation forms.

When you want to customize your payment forms, click on the “Themes” tab, and you can easily build specific structures for certain times throughout the year.

To improve the experience that you give your target audience, MoonClerk also supports email notifications which allow you to send payment confirmations and send receipts to customers. You'll also have the option to enhance your relationship with customers with limited checkout deals and coupons too.

The forms are highly customizable, with various unique fields that you can experiment with. If you're looking to collect specific information from your customer, MoonClerk also allows you to do that. This is very different from the kind of experience that you'd get from PayPal recurring payments, where there's no option to collect custom information.

MoonClerk Review: Branding

The MoonClerk form builder is excellent for companies that want to create personalized brand experiences for their customers. You can choose to add your own logo, change the colors of your forms, and even implement specific fonts to give your interface a more unique experience. Additionally, there are plenty of core parameters to be configured, included trial periods, start dates, durations, checkouts, and more.

To design a form that matches your company's branding, click on the Themes tab in the top menu and make as many different themes as you like, each with their custom background, image, logo, fonts, and custom CSS solutions too.

There's even the option to remove the form title if you want to ensure that the checkout page blends into your website as well as possible.

Remember that once you've built a form for your company, you can preview how it's going to look to your target customers by clicking on the name of the form and selecting the “Preview” button. This makes sure that you're not going to end up publishing a payment form that looks unprofessional or outdated.

MoonCerk Review: Digital Delivery

If your company is selling digital products like ebooks, webinars, or videos, instead of physical items, then it's worth looking into digital delivery. The MoonClerk pricing for digital distribution is $15 per month, which means that it's going to cost you a little extra to take this route.

However, once you've set up your new service, you'll have the option to sell digital products easily, and manage the entire buyer journey from within your MoonClerk account too. The MoonClerk software even takes care of sending the digital product to your customers.

👉 With digital delivery, you can:

- Store unlimited content in your MoonClerk account with unlimited bandwidth for deliveries

- Sell access to digital content in a range of formats either with one-time payments or subscriptions.

- Upload any content type, including eBooks, videos, and audio.

- Style the download and payment page so that it matches your brand perfectly.

When you have digital delivery set up, you'll be able to design payment forms just like you would for any other product.

After your customer has completed the form and entered the payment, they'll receive an email with a link that allows them to access whatever package you've created for them.

The process is very simple and straightforward. What's more, the fact that you can customize the digital download page makes the whole experience feel a lot more professional.

MoonClerk Review: Integrations

One of the things that makes MoonClerk so impressive is the fact that there are so many great ways to improve your experience with the provider. MoonClerk offers a range of direct integrations with various tools like CRM and website builders so that you can combine your sales environment according to your individual strategy.

With the right MoonClerk integrations, you can save information about sales to your CRM, send out custom emails to repeat customers, and so much more. Some of the most popular integrations include:

- MailChimp

- Convertkit

- Google Sheets

- Constant Contact

- ActiveCampaign

- Tapfiliate

- ShipRobot

- Salesforce

- Quickbooks

Intended to be more than just a basic payment processing solution, MoonClerk is packed full of access to other tools and features that will help you to make the most of your business. There are even in-built extra tools like data imports, developer options, and coupon creation too.

MoonClerk Review: Security

One thing that makes MoonClerk pricing easier to bare, is the fact that it comes with the kind of security you need in today's competitive world. The MoonClerk brand advertises its security as being “bank-level,” which means that you get:

- Level 1 PCI compliance

- Secure hosting

- Full SSL encryption

Online transactions and payments are completely protected by MoonClerk using a range of high-level security protocols that are on par with the leading banks around the world. This higher-level security means that you and your customers can rest assured that the checkout process is as simple and secure as possible. You also won't need to provide any additional security measures to improve peace of mind.

MoonClerk Review: Customer Service

No matter how effective and intuitive your payment processing solution might be, there's always a chance that you'll need a little extra help from the customer support team.

MoonClerk is still a relatively small company, which means that they don't have the most comprehensive customer service we've ever seen. However, the personalized service level offered by this company is second to none. You can send the team an email or click on the small green chat tab on the bottom right-hand side of your screen to reach out to a member of the team as soon as possible.

Instant chat isn't available all of the time, but you always have email to turn to if you can't reach anyone. Additionally, there's a helpful blog page and help centre so you can find answers to questions yourself too.

MoonClerk Alternatives

MoonClerk is an excellent recurring billing platform for companies that want to set up simple and customized solutions for accepting client payments. However, this tool isn't going to be the right choice for every company. You might find that MoonClerk is lacking some of the features you need for a complete payment processing solution, which means that it's worth looking at some of the alternatives on the market.

Here are just some of the options you can consider.

Square Payments

If you're looking for a payment processing solution that's perfect for your brick and mortar stores, then Square is exactly the solution that you need. If your business accepts credit cards on-location, then Square is much easier to use as you can access a range of hardware options for taking fees from clients. It's a little more expensive to use Square than some of the other options we've mentioned above, and there are some issues with getting customer support at times, but it's a great tool all-around.

Pros 👍

- Excellent for in-person billing

- Plenty of hardware options available

- Easy to use

- Lots of added extras

Cons 👍

- More expensive than some alternatives

- Not great when it comes to customer support

👉 Read our full Square reviews.

Chargebee

Chargebee is another recurring billing and subscription software that allows you to automate your recurring billing processes to better manage those long-term payments. You can send invoices, add notes to specific payment requests, and even track your unpaid invoices to ensure that you don't miss out on an essential payment. Unfortunately, there's no free trial to get you started.

Pros 👍

- Recurring billing is easy to use

- Advanced invoices available

- Themes for hosted pages

- EU VAT support

Cons 👍

- No free trial

- Not as advanced as some other options

👉 Read our Chargebee review.

Zuora

Designed for larger enterprises, Zuora is one of the major competitors in the world of subscription businesses. It's generally used among Fortune 500 companies and ensures that large companies can power recurring payments with ease. Unfortunately, Zuora requires substantial IT knowledge and a lengthy onboarding process. It can be an excellent solution for automating billing, but it's also costly compared to some of the other options on the market.

Pros 👍

- Stunning and highly customizable payment options

- Great for larger businesses

- Excellent security and performance

- Designed for Fortune 500

Cons 👍

- Expensive

- Lots of coding knowledge required

Chargify

Chargify is another well-known tool designed to help companies accept payments for subscriptions and recurring fees. This tool gives organizations the power to effectively manage a host of subscribers in a unique and intuitive environment. The tiered pricing means that it's easy to understand precisely how much you need to set aside for your software each month.

Pros 👍

- Plenty of add-ons and extras

- Metered usage with tiered pricing

- One-time charges available

- Calendar billing

Cons 👍

- Not as advanced as other tools

- Updating contact information is difficult

MoonClerk vs Stripe: What’s the Difference?

MoonClerk runs off the Stripe payment processing system. This might leave you wondering why you would pay for a monthly subscription to MoonClerk when you could just use Stripe directly.

Crucially, there’s a big difference between what Stripe and MoonClerk can offer.

Stripe is a payment processing solution that handles wen and mobile payments for merchants. With Stripe, you can access a flexible environment for accepting payments over the internet. Stripe offers access to things like APIs and integrations that allow businesses to instantly integrate payment processing into their websites and apps.

Using Stripe alone, you could create a payment portal for your customers, and Stripe will handle the back-end security and transfers for you. However, Stripe doesn’t offer the extra support that you get from MoonClerk when it comes to setting up and running your business.

Without MoonClerk, you wouldn’t be able to set up recurring payments with Stripe, or memberships for your customers. You would also need to make a website and host it separately, because Stripe only offers the payment processing, not the hosting functionality.

MoonClerk works on all mobile and desktop devices, helping teams to build a genuine online presence. The system also takes care of security and privacy protection and gives business owners more flexibility on their payment methods. You can also add custom branding to your transactions with MoonClerk – that’s something you don’t get with Stripe alone.

Through MoonClerk integrations with tools like Mailchimp and QuickBooks, you can also automate a variety of business processes. For instance, you can track your tax and vat requirements, filter and export business data, and experiment with developer tools.

MoonClerk vs ChargeBee

Both MoonClerk and ChargeBee offer payment processing and management solutions. While both of these software options are excellent for business leaders, the right one for you will depend on what kind of functionality you need.

For instance, if you’re running a brick and mortar company, then MoonClerk already has a lot of experience supporting companies just like yours. MoonClerk is also an excellent choice for companies that feel comfortable with the Stripe payment processing experience.

MoonClerk is popular for donation websites that have to set up simple recurring payments for donations. With MoonClerk, you can accept donations, set up recurring and one-time payments, send payment notifications, and so much more. There’s also a payer portal where you can send customers a link to a page where they can update their credit card information.

MoonClerk also offers payment forms, and basic integrations with tools like MailChimp and Google Analytics. On the other hand, ChargeBee might be a better option if you’re a startup creating a web application that requires a more robust API, recurring billing, and complete control over user flow.

ChargeBee offers plenty of access to things like APIs and webhooks for customization. There are also integrations already available with Salesforce and QuickBooks. ChargeBee supports detailed reporting, support for global taxes, MRR, churn, and cohort analysis. There are also enterprise-level plans for complex billing models, and automated accounting.

ChargeBee benefits from multiple payment gateways, including Braintree and Authorize.Net, whereas MoonClerk is only suitable for use with Stripe.

MoonClerk vs. PayPal

Comparing a solution like MoonClerk to something like PayPal is a little complicated. MoonClerk is a solution for managing ongoing and recurring payments. It helps businesses to gain more control over transactions, while also providing payment processing through Stripe.

On the other hand, PayPal is a comprehensive payment processing solution. PayPal does offer recurring payments as an additional solution for specific companies. While both PayPal and MoonClerk offer recurring payments, you can’t create your own forms with PayPal to collect customer information. However, this is something you can do with MoonClerk.

The information you collect from your MoonClerk forms also appears within your dashboard, so you can access it wherever you need it. PayPal also has more issues with people having “frozen accounts”. Stripe generally delivers a more reliable experience for customers that want to receive money 2 days after a successful charge. Funds are automatically transferred to a bank account on a 2-day rolling basis with MoonClerk and Stripe.

MoonClerk also built its technology from the ground up with smaller businesses in mind. It’s ideal for people without a lot of technical know-how. On the other hand, PayPal can be a little more complicated to navigate. There also aren’t a lot of options for integrations or extensibility with PayPal.

Another major difference between PayPal and MoonClerk is the cost. You need to start your base monthly fee with PayPal at around $20 if the other person doesn’t already have PayPal. MoonClerk is a little cheaper, at $15. Additionally, if you’re redirecting customers to PayPal to check out, they’ll often get a set of pop-up ads which are designed to promote PayPal instead of your company.

With PayPal recurring payments, you also have a problem when someone signs up for a recurring plan, as it’s hard to transfer customers over into a new system. Because MoonClerk builds on Strike, transferring customer data is easier.

Is MoonClerk Safe?

Choosing the right technology for accepting online payments isn’t always easy.

You need to ensure that you’re not only choosing the technology that’s easy to use and reliable. It’s also important to find something that’s going to protect you and your customers during these all-important transactions.

If you’re concerned about using MoonClerk, you can find some extra information on the safety of the technology and it’s features at http://help.moonclerk.com or you can contact the team. The customer service group will help to answer your questions about everything from pricing plans, to encryption.

In general, MoonClerk takes security very seriously. There’s full high-level SSL encryption for the checkout process. Additionally, all browsers interact with MoonClerk payment forms using HTTPS. Essentially, you’re getting bank-level security every time you use MoonClerk to take a payment.

Both you and your customer should be able to rest assured that data isn’t going to leak anywhere. Additionally, PCI compliance is included too. The PCI compliance included with MoonClerk is available at a service provider level. This is the most significant service level available. It means that all credit card numbers are encrypted.

Check out the MoonClerk website to learn a little more about how security works. The good news is that you should enjoy a relatively reliable and safe experience for your business and it’s customers, provided that you use the service well.

MoonClerk Review: Conclusion

So, is MoonClerk right for you?

Well, it's currently one of the leading options for recurring billing software on the market, used by companies all around the world. MoonClerk features a range of fantastic solutions to help you make the most out of your business, from customizable invoices to the option to take mobile payments. There are even fantastic personalized forms available too.

Regardless of what you want to sell, a reliable payment processing application will always be a crucial component of running an effective business. MoonClerk allows you to get paid faster by ensuring that all you need to do is send someone a link to have them clear their invoice immediately. You can also automate your back-office by setting up recurring payments so that MoonClerk takes care of charging your clients according to your schedule.

If you've ever had to handle recurring payments and invoicing manually before, you'll know how valuable a system like this one can be. Another fantastic thing about MoonClerk is that it's all designed to suit beginners and smaller businesses. That means that you don't need an advanced IT team to use the software, you can instead enjoy the benefits of a solution that's easy to set up and use in a matter of minutes. Without entering a line of code, you can have your payment strategy up and running within 5 minutes.

The post MoonClerk Review: Recurring Payments Made Simple (Sep 2020) appeared first on Ecommerce Platforms.

from Ecommerce Platforms https://ift.tt/2YAzK5H

from Ecommerce Platforms https://ift.tt/2YAzK5H via IFTTT

via IFTTT

No comments:

Post a Comment