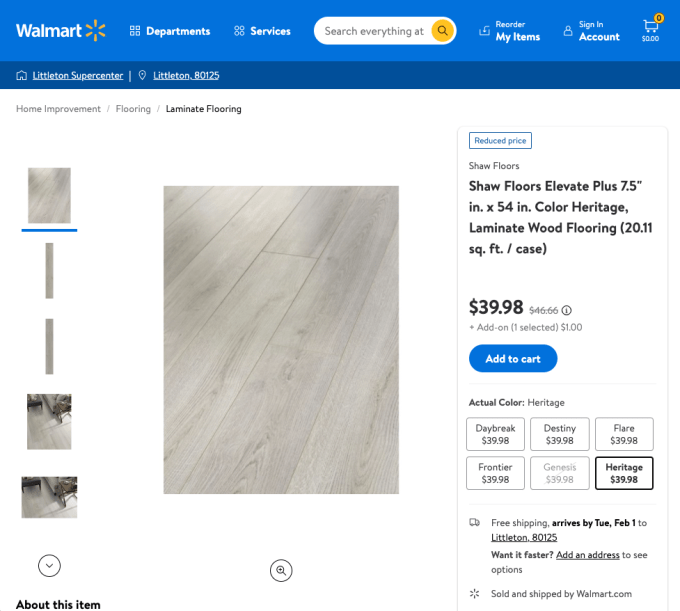

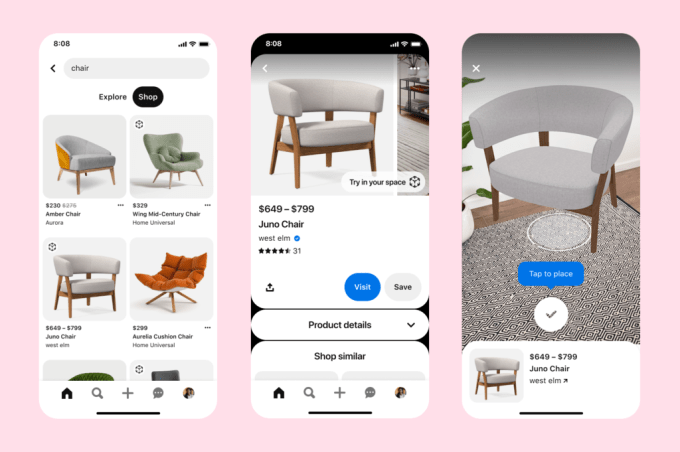

A new Pinterest feature will allow consumers to see what furniture or other home décor items will look like in their own home, using augmented reality (AR). Similar technology has already been put into place by major retailers, like Amazon, IKEA or Wayfair, as well as others in the home design space, like Houzz. In Pinterest’s case, it’s working with a select group of U.S. retailers including Crate & Barrel, Walmart, West Elm and Wayfair, to allow online shoppers to virtually place items in their home using the Pinterest app’s “Lens camera.” If the user then likes what they see, they can proceed to purchase the item directly from the retailer.

This virtual shopping experience for home décor is launching in the U.S. across more than 80,000 shoppable Pins, which makes it Pinterest’s largest AR shopping investment to date.

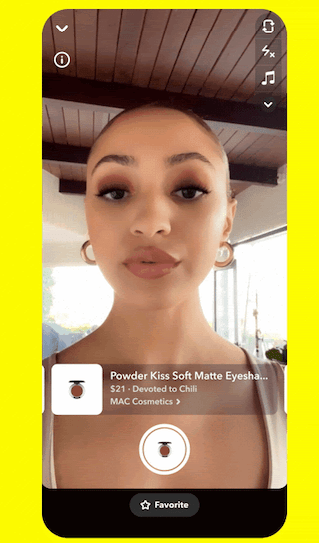

It’s also the third “Try On” product Pinterest has launched over the past two years. Its first efforts were in the beauty market, with Try On features that allowed consumers to virtually experiment with different lipstick shades and eyeshadows, totaling 14,000 shoppable Pins. Pinterest had not yet worked with placing items directly in a room, in other words — only on users’ faces. While not quite the same technology as before, all of Pinterest’s Try On experiences have the same goal of turning product inspiration into purchases.

To use the feature on iOS or Android, users in the U.S. can click supported home décor Pins then click “Try in your Space” to see the virtual product through the camera lens. Users can adjust the product in their own space and browse the product information, including pricing. To purchase, they just click the Pin again to be directed to the checkout page on the retailer’s website.

Image Credits: Pinterest

This attempt to funnel consumers’ more casual browsing into retail transactions has been Pinterest’s larger focus over the years. But the company has been slow to adapt to various market shifts, including the move away from static images to video as shopping inspiration, for example — at least until more recently. Last year, the company belatedly entered this space with the launch of its debut video-first product, Idea Pins, and has since invested in creator tools that would allow online influencers to make money from their content.

Pinterest is also clearly not the first to market with its new AR feature for shopping furniture and décor. But the AR shopping market is still early. Here, initial adoption has been limited by the tools available to AR developers, like Apple’s ARKit, which has steadily improved over time to make the end-user experience less cumbersome and clunky. And app makers are still figuring out how to make AR shopping appealing to consumers. Just last week, for instance, Snapchat upgraded its own AR features which now include a shopping Lens that lets consumers browse multiple products in one place with real-time pricing.

While some of the early experiments in AR shopping have felt more gimmicky, there are some indications that using AR can help retailers increase conversions when done well. And there may be some consumer demand for this type of experience. For example, a Google survey from 2019 indicated consumer interest in AR, with 66% of people saying they wanted to use AR for help when shopping. But real-world research and data on conversions have been more limited. However, e-commerce platform Shopify shared that merchants who were adding 3D content to their stores were seeing a 94% conversion lift, on average, citing its own internal data. And some merchants who used 3D models in AR had increased conversion rates by up to 250%, Shopify said. It also cited 2020 research by Vertebrae which found that conversion rates increase by 90% for customers who engage with AR, versus those who don’t.

Pinterest, meanwhile, noted that its own users are 5 times more likely to purchase from a “Try On”-enabled Pin than a standard Pin. It also said that home décor is the top category on its site, with 3.37 billion search clicks in 2021. That makes this latest AR initiative one with a potentially larger audience than its AR beauty shopping features. The company touted its visual search feature, where usage increased by 126% year-over-year, but didn’t offer hard numbers in terms of total searches.

“Since the pandemic began, we’re seeing more digitally savvy shoppers than ever before, as millions of people now expect virtual and mobile options to try before they buy, see personalized recommendations, and gather information as part of their decision-making process,” said Jeremy King, SVP of Engineering at Pinterest, in an announcement. “These behaviors are happening across Pinterest every day, which is why we’re continuing to advance technologies like AR Try On and make Pinterest a full-funnel shopping destination that takes people from inspiration to purchase anywhere in the app.”

The company told TechCrunch it’s not currently monetizing its AR shopping feature. But its retail partners on the efforts are brands who have already seen both organic and paid advertising success on Pinterest, and are now taking advantage of another way to allow consumers to discover products organically.

The AR shopping feature is U.S.-only on iOS and Android at launch, but will later roll out to global markets, Pinterest said.

from eCommerce – TechCrunch https://ift.tt/n8ZQNoOSd

from eCommerce – TechCrunch https://ift.tt/n8ZQNoOSd via IFTTT

via IFTTT